Time for threats and updates

Let's start with the political events that shocked dollar.

First, market reacted to an airstrike by the US Air Force on targets of Syrian armed groups supported by Iran (according to Pentagon). Officially, this action (of deaths from 17 to 27 people) was a response to repeated attacks by militants on US military personnel and representatives of the international coalition in Iraq. Reaction of Iranian authorities was restrained, but consultations on thenuclear issue were suspended.

Then the dollar received support from the US National Intelligence, whose representatives directly accused the Crown Prince of Saudi Arabia, Mohammad bin Salman, of organizing the assassination of opposition journalist Khashoggi. Treasury Department and the US State Department have imposed sanctions against dozens of Saudi officials. Recall that Saudi Arabia is main member of Coalition against the terrorist organization ISIS and an important political partner of US in the Arabian Peninsula. Therefore, such a sharp attack by Washington against the de facto leader of this country discouraged not only politicians but also representatives of big business.

Let's move on.

- USA

The lower house of US Congress passed a bill on a package of fiscal incentives to overcome consequences of coronavirus of $1.9 trillion, taking into account the increase in the minimum hourly wage to $15 per hour by 2025.

This week, Senate will amend the bill to eliminate at least an increase in the minimum wage and send it back to the lower house for approval. Democrats intend to have time to ratify bill before the expiration of extended unemployment benefits on March 14.

Next step is to raise taxes to finance a new $3.0 trillion stimulus package.

American lawmakers have reiterated that sometimes tough decisions are worth making. Trump, twice acquitted, is set to announce his intention to run for president in 2024 tonight. And it doesn't matter whether the «second coming» of red-haired catastrophe in politics actually takes place, but the announcement about this already creates extremely negative expectations for the financial markets. Trump will definitely revise all the agreements concluded during the Biden period, at least this applies to Iran, China, Russia, North Korea and others. But let's be optimists: we have another 3 years, let's hope that during this time Trump will either grow wiser or ... become irrelevant.

- Great Britain

Announcement of the «road map» on lifting of quarantine measures was positively received by market participants. The BOE report in the British Parliament first caused a speculative decline in GBP/USD: the regulator does not rule out adoption of additional monetary stimulus due to rising unemployment and negative pressure on inflation.

However, Bailey said that reducing the size of QE program or extending it in 2021 depends on functioning of financial markets and the economic outlook. BOE stands ready to review size of QE program at each of its upcoming meetings.

As a result, the pound removed large StopLoss in the 1.40 zone and stopped to renew its interest in growth. Another round of downward correction is possible, but the global upward trend continues.

Pay attention to the publication of PMI data for industry and services, as well as the budget presentation by British Chancellor Sunak. Project envisages extending measures to support the labour market until September but is already preparing to raise taxes as the economy returns to growth.

Summit OPEC+outside OPEC will be held via videoconference. Cartel believes that the current oil growth is poorly justified, and is ready to announce a further increase in oil production by 0.5 million barrels per day, and Saudi Arabia intends to abandon the voluntary reduction in oil production in the amount of 1 million barrels.

February NFP will have a direct impact on the Fed's rhetoric at the March 17 meeting. A weak report will give Powell a reason for a verbal attempt to influence the dynamics of T-Bills if only Fed refrains from direct intervention in the debt market even before publication of report. A strong report will leave the rear of Fed open, Powell will have to invent something new besides repeating rhetoric of willingness to be patient and not thinking about tightening policies.

Discrepancy between a proxy and actual NFP data in January was so significant that there is no doubt about the strong February revision report for the past month. Market reaction to the weak report will be short-term, while the strong data will exacerbate hysteria in US debt market.

In addition to NFP, following data are of interest this week:

- USA − ISM of Industry and Services, ADP report, weekly jobless claims. Fed Beige Book, Trade Balance for February.

- Eurozone − consumer price inflation, industry and services PMIs, retail sales and unemployment in EU, retail sales and German labour market report.

- China − PMI of industry and services. Annual session of the National People's Congress will begin in Beijing on Friday.

Powell will speak at the WSJ Labor Market Summit Thursday; as a rule, at such events, there is no announcement of changes in the Fed's policy, but given approaching «silence period» at Fed before March 17 meeting, it is better to listen to Jay's markets carefully.

Lagarde will publish a pre-recorded interview today, but he won't say anything new. On Thursday, a «week of silence» will begin before ECB meeting on March 11.

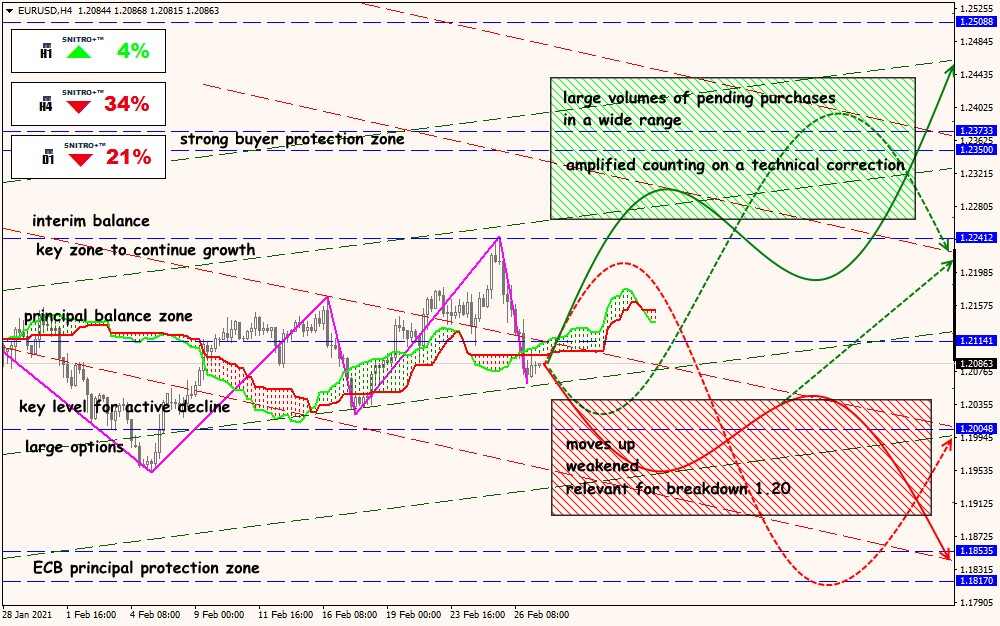

Technical Analysis of EUR/USD

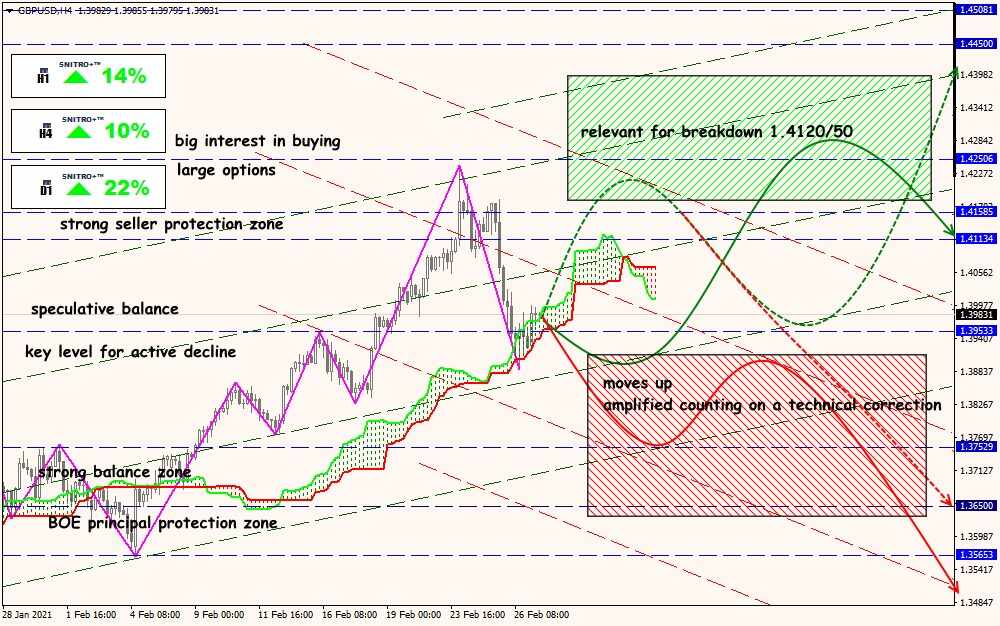

Technical Analysis of GBP/USD

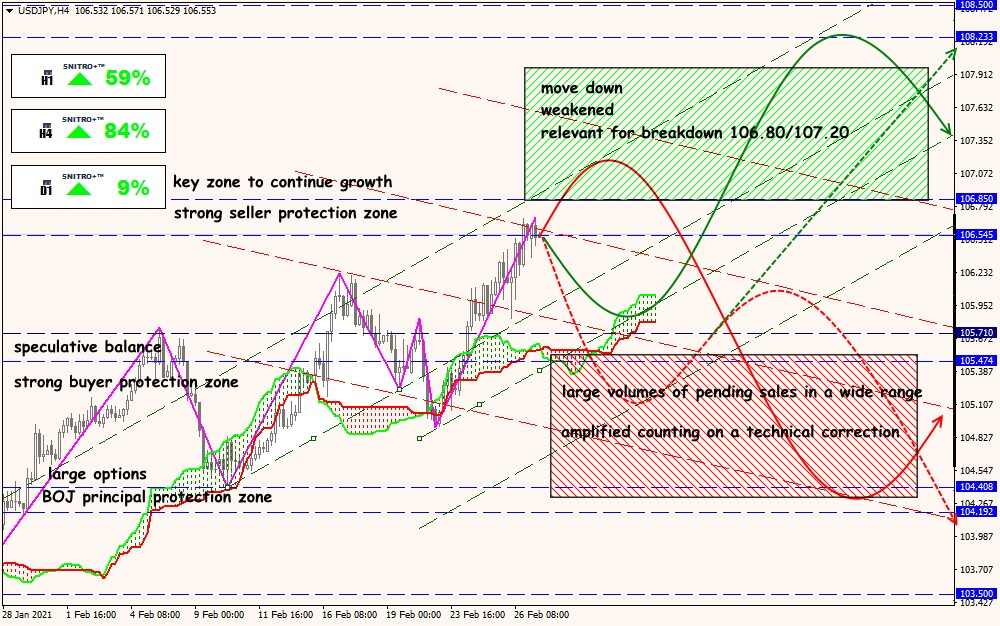

Technical Analysis of USD/JPY

Technical Analysis of XTI/USD