Under the sign of Trump or who the dollar is afraid

The auction for the Mexican wall, the Irish border and the European cars continue.

As expected, May suffered the next defeat in parliament during the vote for the mandate on the change of guarantees of Britain on the support of border with Ireland at negotiations with the EU. The Prime Minister does not lose hope to manage to get new concessions from the EU, but corrected the position, having said that guarantees of the EU about the temporality of the border can be given also without the amendments to the global agreement.

Apparently, in the EU lost interest in negotiations with May and current week the meeting with Corbyn is planned who supports constant membership of Britain in the Customs union with the EU. If till 27 February the agreement and its ratification by Parliament of Britain is not reached, then May's resignation and early re-elections in Parliament are inevitable, and in the auction for Brexit, most likely, there will come the pause.

After a January somersault in monetary policy, the markets wait for unpleasant surprises from each document of FRS. And though, in general, the publication planned for Wednesday became obviously outdated, it is worth reading carefully and to look for differences in Powell's rhetoric during the January press conference and the official text. Only two key moments:

- rates: any hint on the revision of a situation in March will cause the short-term growth of dollar, if correction is postponed until June – there will not be a reaction;

- the balance of FRS: the separate document indicating a possibility of a revision of policy on reduction of balance is for the first time processed and these expectations are not put in quotations yet. Concrete dates will not be told, of course, but if the purpose to reduce balance until the end of the current year is recognized as relevant, then the growth of share assets and steep decline of the dollar are guaranteed.

Anyway, the publication can press only in short term for the dollar as after a release of failure retails and considering shut down GDP growth in 1 quarter will hardly exceed 1.5-2% that supports expectations of the markets in lack of further increases in rates.

From Trump's chronicle:

- The bill on the budget of the USA was signed almost together with the imposition of the state of emergency to receive full financing of a treasured wall on the border with Mexico without the permission of the Congress. Democrats suited Trump for the excess of authority; most likely, the decision will be made not in favor of the President, but hardly it will stop it.

- The federal court found Manafort guilty of a lie that cancels probability of free pardon by the President. Completion of investigation of Mueller on communications of Trump`s command with the Russian Federation will actively press on the markets for 1-2 months.

- Trump actively comments on progress in negotiations with China, but there is no real break after all. The parties are ready to sign only the general letter of intent which can potentially become the main for the global contract. Trump considers a 60-day delay on increase in rates but is skeptical about assurances of Beijing about a reduction in compliance to rules of the WTO of programs of support of the state enterprises.

- Against the background of the budget scandal, Donald urgently needs any positive, at least verbal, to control the stock market in the process of transition to the active blackmailing of the EU and Japan by increasing import duties on cars. The most rigid option – increase for 25% can cause the steep decline of euro with rollback within 1-2 weeks; more loyal options – increase for 10% or only for electric vehicles − are already considered by the market.

- Trump (and Europe?) has 90 more days to decide the issue with autoduties. The European Commission representative Rosario once again reminded that Brussels already made the list of export goods of the USA in the amount of €20 billion on which response restrictions can be imposed.

- The fate of the scandalous bill NOPEC is not clear yet, obviously, Trump waits for exclusive concessions from all interested parties. Oil managed to continue growth against the background of a considerable reduction of volumes of production and weak, but, nevertheless, the stated optimism on trade negotiations between the USA and China.

Today the markets of America have a rest, but statistics is not canceled. We pay attention: regarding the USA − durables, the production index of FRB of Philadelphia, data on the sector of the real estate, PMI of the industry and services for February; on the Eurozone − PMI of the industry and services, the German ZEWI IFO indexes, inflation of EU countries for January, tomorrow Britain will publish the report on labor market.

The current week the head of FRB of New York Williams and the Vice President of FRS Clarida will act, the reaction of the markets to their performances can be strong. Draghi will act in Italy on Friday and though the official subject of performance is far from perspectives of the policy of the ECB, Mario can shed light for the period of the start of TLTROs. In the absence of signs of a recovery of the economy of the EU, euro will be under the descending pressure prior to a meeting of the ECB on 7 March; the protocol of a January meeting is published on Thursday − we read attentively.

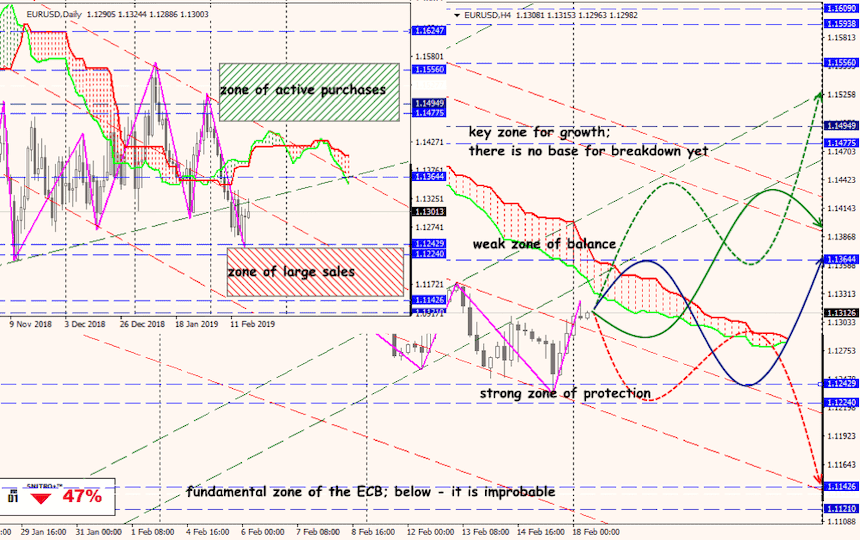

Technical Analysis EUR/USD

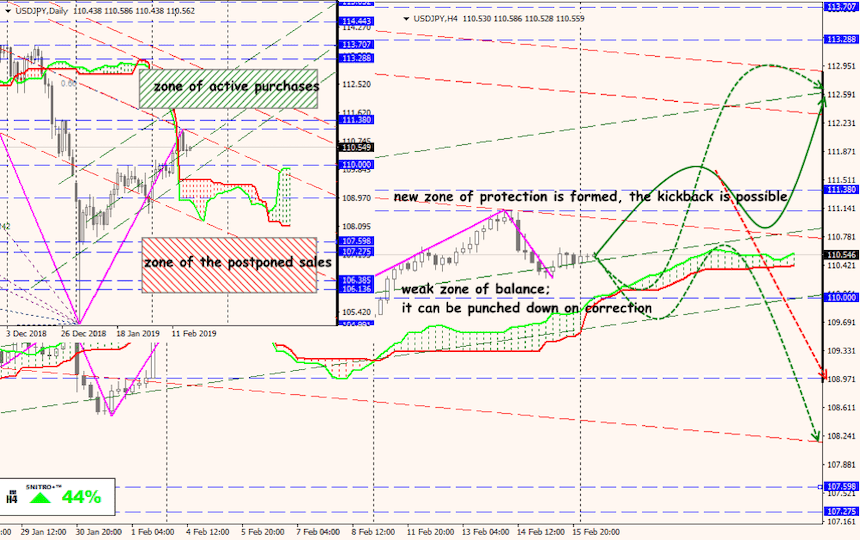

Technical Analysis USD/JPY