Contents

- Peculiarities of the candlestick pattern analysis

- An example of trading candlesticks strategy based on Engulfing pattern

- The candlestick forex strategy with «Free candle» indicator

- General remarks regarding candlestick trading

If you prefer day trading, being skeptical to indicators, then Japanese candlestick forex trading strategy would meet your expectations. Candlestick patterns enable a trader to determine the market situation as well as supply and demand balance.

Peculiarities of the candlestick pattern analysis

The longer the «body» of the candlestick in forex, the stronger the Momentum and the greater the potential to move in specified direction. A «bullish» candlestick with the large «body» and the short «shade» shows that the buyers influence the market more than the sellers. A «bearish» candle with large body and short «shade» means that the market supply is stronger than demand. A long «shade» in specific direction means that in the process of the candlestick’s formation in forex the supply and demand balance has shifted. The changes of the market expectations can be determined by comparing the candlesticks with each other.

The short shade fr om one or the other side indicates greater chances of the movement in definite direction. Relatively equal «shades» provided the candlestick’s body is small (Doji candlesticks for forex pattern) represents market indecision - the pressure on the buyer’s and seller’s price is approximately the same. In such circumstances, even a small growth in volume of trade may cause a strong price movement; more often there is a trend to reverse.

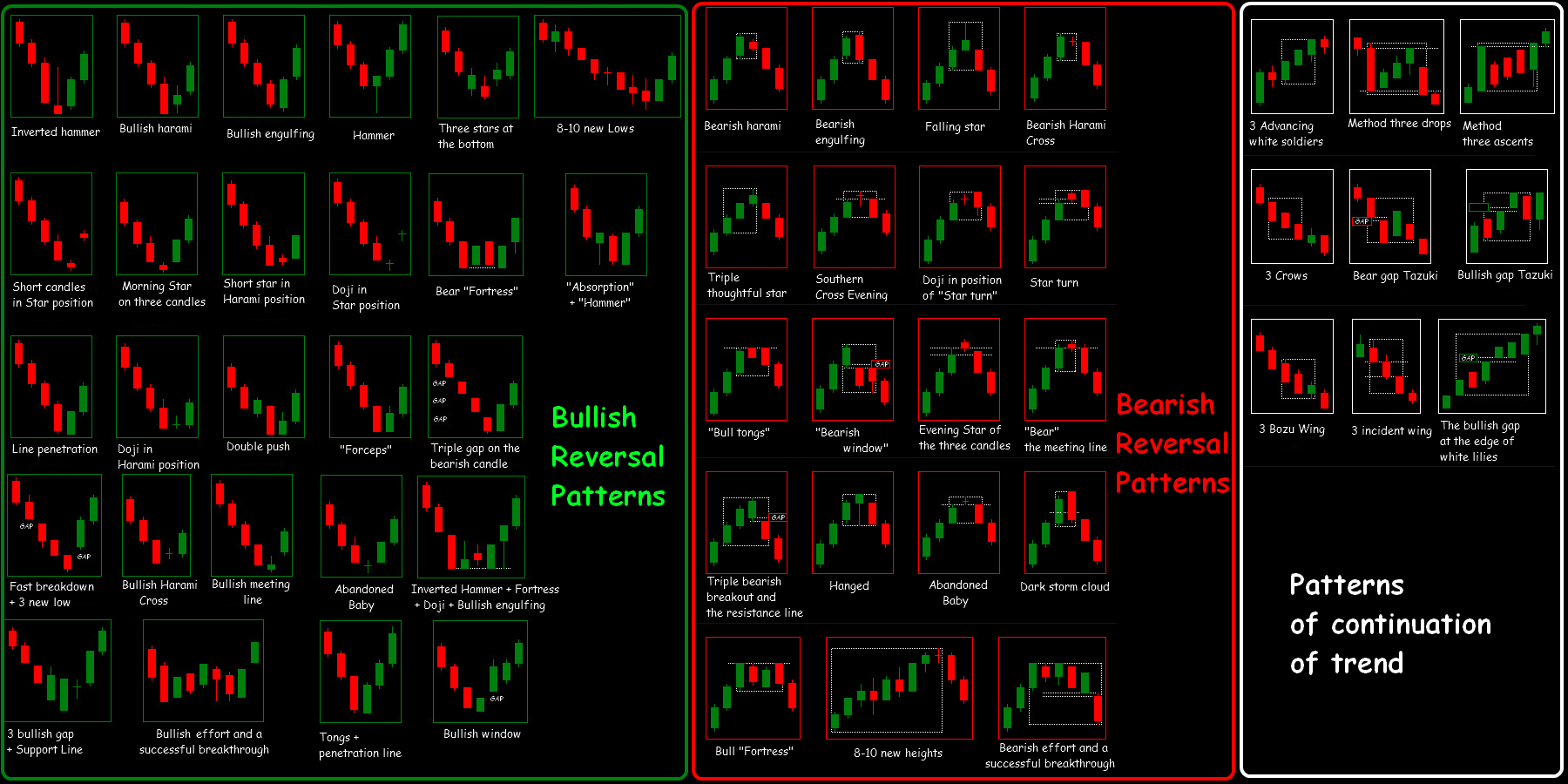

Let us remind the main candlestick trading systems:

The candlestick patterns which may be defined as reversal patterns warn not only about reversal trend but also about the lateral movement start or exit from it; and sometimes about reduction of the movement’s speed without change of the direction. Any pattern makes sense only wh ere it reaches the strongest level. If reversal pattern succeeds then it will be followed by continuous definite movement.

All trading patterns made up of 1-2 candlesticks would lose their significance if during current movement (trend or correction in price movement) this pattern applied more than once. This is especially true for Doji candlestick patterns. The most reliable Japanese candlestick signals appear on Daily timeframe. Following timeframe decrease, the reliability of the signals lowers.

An example of trading candlesticks strategy based on Engulfing pattern

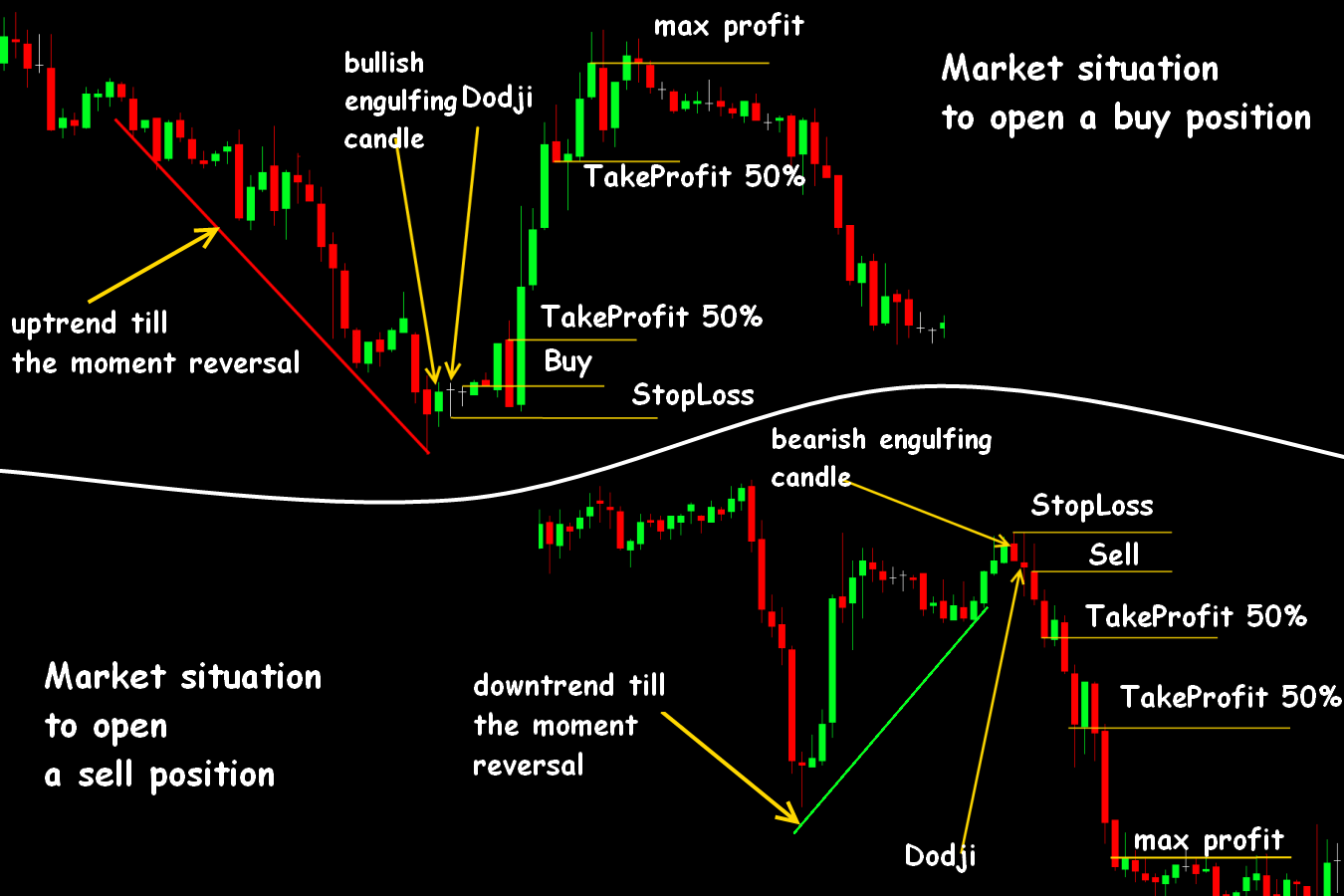

Candlestick forex trading strategy uses this candlestick pattern as reversal signal or the correction start.

Trading asset: any currency pair.

Trading period: the European and the US sessions.

Timeframe: D1 or H1.

Candlestick trading strategy for signal to buy:

- The formation of candlestick «engulfing» pattern is required on the low of the downward trend.

- The signal is confirmed: it can be Doji candlestick pattern or one more Engulfing pattern in the same direction.

- Low of the first Engulfing pattern must not be renewed, moreover - the more remote the price, the stronger a trading signal.

At the moment of the next candlestick opening we will open a long position. Stop Loss will be fixed below a Low confirmation signal.

Candlestick strategy forex for signal to sell:

- The formation of candlestick «engulfing» pattern is required on the high of the upward trend.

- The signal is confirmed: Doji candlestick pattern or one more Engulfing pattern in the same direction.

- High of the first Engulfing pattern must not be renewed.

We will open a short position at the moment of the next candlestick formation. Stop Loss will be set above the High confirmation signal.

The candlestick forex strategy with «Free candle» indicator

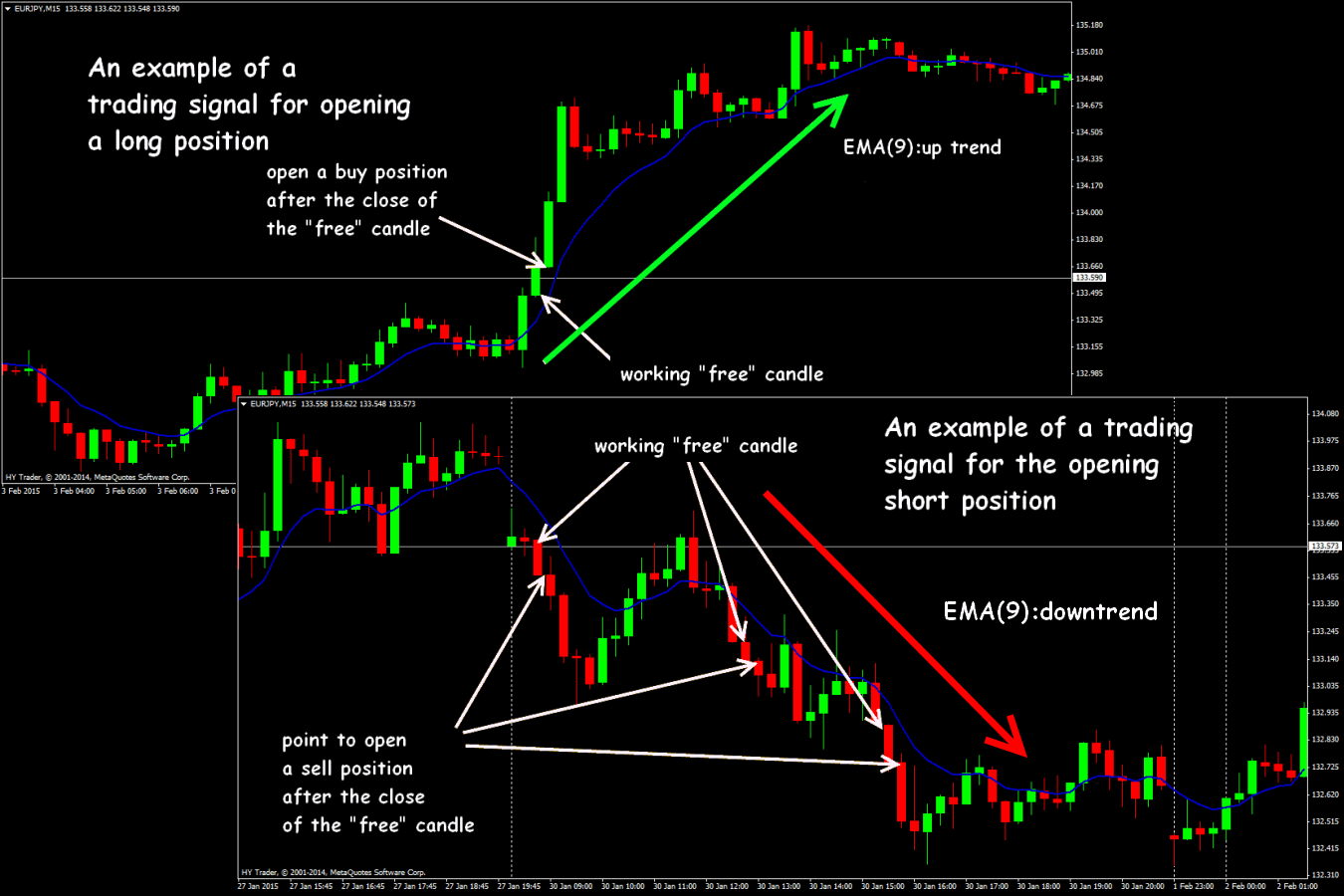

The trading strategy uses candlestick patterns with high reliability level and sliding average for the determination of the current trend. EMA(9) is advised for the popular currency pair trading on M15 timeframe. «Free candle» is considered to be a fully formed 15-minute candle, body and shade of which do not touch EMA (9) line, and the closing price of the candlesticks in forex trading is not higher/lower the previous extreme. «Free candle» must have the average «body» and average «shade» («hammer», «dodji» reversal patterns and GAP are not applicable).

Trading asset: EUR/USD, USD/JPY, USD/CHF, GBP/USD, EUR/GBP, EUR/JPY, GBP/JPY.

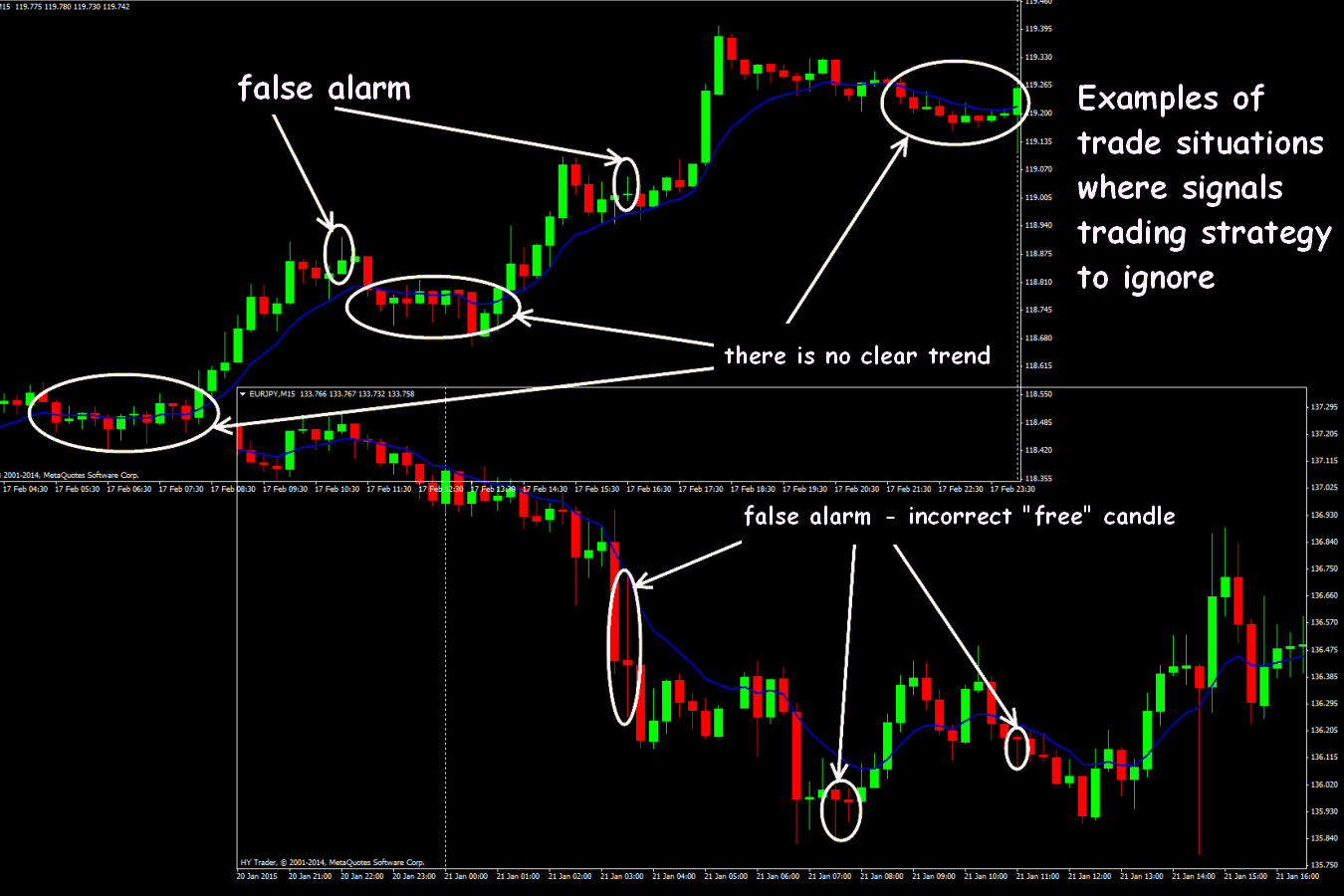

Trading period: the European and the US trading session. Candlestick forex trading in the periods of the market’s indecision is not advisable.

The main trend’s direction is determined by EMA(9). For the long position (buy), the existence of the «free» bullish candle above EMA(9) is required. The next candle’s entry after «free candle» or a Buy Stop order should be slightly higher than the closing price. The Stop Loss is fixed in max level of the «free candle».

For a short position (sell) a «free bearish candle» should be fixed below the moving average. The entry at the opening of the next candle depends on the market or should be made by a pending Sell Stop order. A Stop Loss should be fixed 3-5 points below min of the «free candle». For setting of Take Profit, two ranges of the «free candle» should be used.

A good moment for the entry when it comes to candlestick strategy trading in regard to main currency pairs appears within 15-30 minutes after the European session opening, when the market direction has been determined. The average duration of the open deal is up to 1 hour. It is not recommended to trade without Stop Loss or enter within first 5 minutes of each hour.

The deal should be opened unless:

- distance from closing price of the «free candle» to ЕМА(9) is less than 3-4 points;

- body of the «free candle» is less than 10 points.

From the mathematical expectation prospective, the «free candle» forex candlestick trading is sufficiently effective, if the deals are not made too often and only in reliable configurations.

General remarks regarding candlestick trading

Forex candlesticks analysis comprises of a variety of types, which may involve from 1 to 6 candles. The majority of patterns work more efficiently in the main trend direction, the reversal patterns considered to be weaker. In intraday trading, the main trend on the greater timeframe should be taken into account.

If after receiving of the candlestick signal, the movement in the market does not confirm it, then the trend will probably flow in the opposite direction. The principles of the capital management are mutual for any forex candlestick trading strategies. For the long positions Stop Loss is fixed 5-10 points below the candlestick pattern’s minimum, while Take Profit is 10 points lower than the maximum of the previous fractal. For the short position rules for fixing Stop Loss/Take Profit are similar.

Neither forex candlestick pattern can be a trade signal itself, nor can it be used for indicating of the possible entries. The pattern just shows the expectations in the market and signalizes the possible changes. For seeking of the entry, another methods of analysis rather than Japanese candlesticks should be used.