Contents

- Trend following

- Contrarian investing

- News trading

- Scalping

- Range trading

- Rebate trading and Price action

- Artificial intelligence

Forex intraday trading strategies are speculative strategies used for selling and purchasing financial instruments in the securities market within the same trading day. Day trading occurs within a short time period, and therefore market players need to find the best intraday forex strategy with the aim of succeeding in their transactions. Below, we are going to investigate the most widespread forex trading intraday strategies.

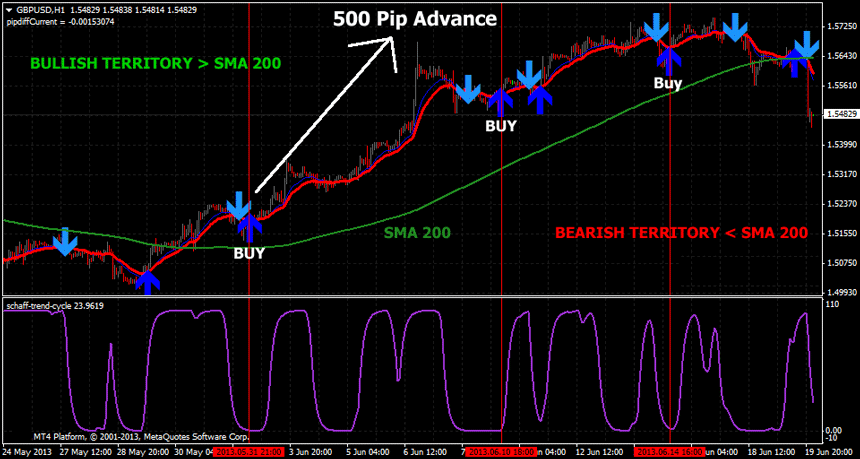

Trend following

This intraday forex strategy assumes that market actors analyze price movements of stocks rather than the financial strength of companies. Trend following is a simple forex day trading strategy under which market actors believe that the current trends persisting in the stock market will remain in force. Thus, if the price for stocks rises, it will be likely to continue growing, and therefore the investor is interested in purchasing such stocks. To the contrary, if there is a downward movement of stock prices, the investor will be interested in short selling such stocks.

Contrarian investing

Contrarian investing consists in the investor's actions to purchase or sell stocks in contrast to the existing market trends. Thus, if the price for stocks drops, the investor purchases such stocks, and to the contrary, if their price goes up, the investors sells them, in both cases expecting the trend to reverse soon. This may be the best forex intraday strategy when the investor has confidence in either of the two main preconditions:

- Stocks enjoy excessive demand in the market, and are overpriced, i.e. there is excessive optimism (high price > sell);

- Market pessimism is extremely high and drives the value of stocks below their market price (low price > purchase) (see picture below).

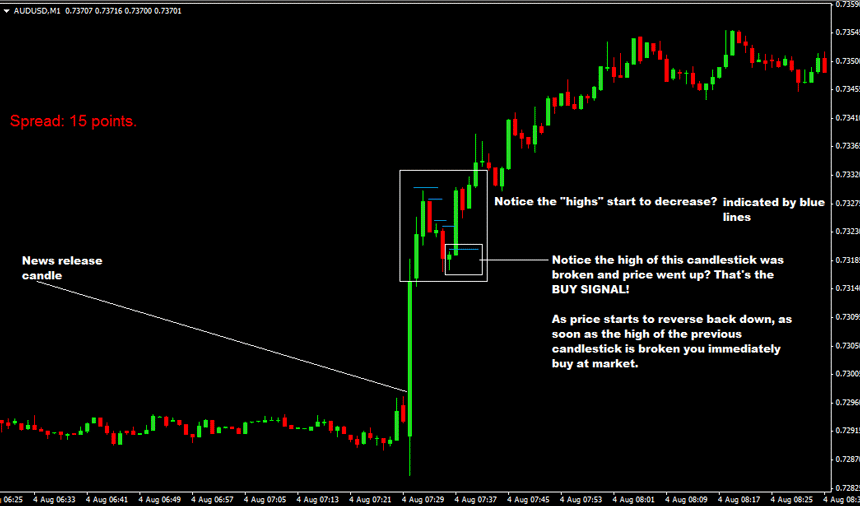

News trading

Under the news playing forex intraday strategy, the investor purchases stocks as soon as some positive news are obtained regarding the expected growth of such stocks' price, or to the contrary, sells stocks as bad news emerge.

The factors which may make the investor use the news playing intraday forex strategy may range fr om market factors (such as investors' expectations, forecasted price fluctuations, negative or positive economic dynamics, etc.) and up to various political and other factors not directly related to the forex market. Therefore, in order to benefit from news playing, the investor needs to be well aware of the multitude of variables affecting market dynamics, and should be able to monitor closely any their changes for quick response.

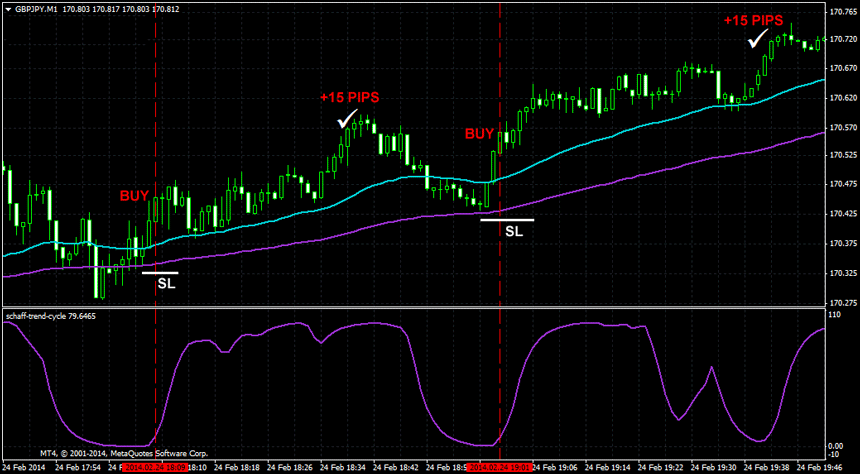

Scalping intraday forex strategy

This forex intraday strategy for trading stocks is based on the detection of small gaps in the buy-sell spread, and the initiation of a large number of short-term intraday transactions with small yields. A position within the scalping strategy is usually opened and closed quickly, with the aim of benefiting from the currently available price gaps.

Due to the fact that the scalping forex intraday strategy is implemented within limited time periods (usually 3 to 5 minutes, less often up to 13-15 minutes), this strategy is rather risky, and it imposes several key requirements for the scalper to be effective. Thus, first of all, the broker needs to process all bids quickly, as even seconds of delay may make the transaction ineffective. Next, scalping needs to be permitted for short-term transactions on the respective exchange. Finally, great buy-sell spreads should be avoided, as they may minimize the already limited profit margin, thus making scalping financially ineffective.

Scalping may be the best intraday forex strategy in the conditions of growing market volatility and fluctuations, which allows the market actors benefiting from the short-term imbalances occurring during those periods.

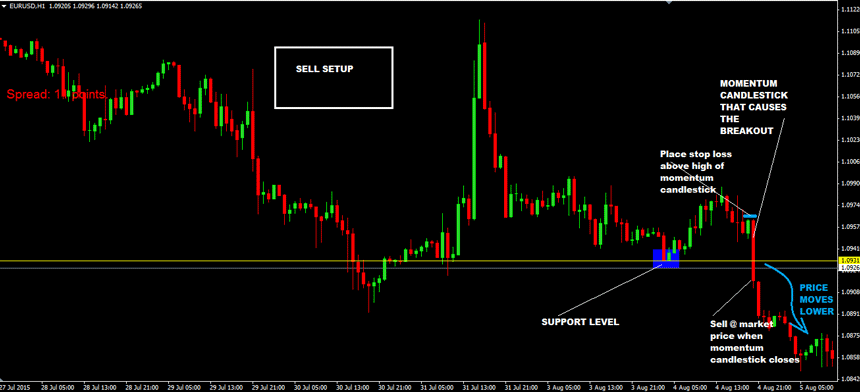

Intraday Forex strategies - Range trading

Range trading intraday forex strategies are based on the investor's assumption that as soon as the price of stocks reaches its highest soil, it will fall back to its lows, and vice versa. Therefore, when the price hits its upper soil, the investor sells, and to the contrary, when it reaches its lower soil, the investor buys.

In practice, within this intraday forex strategy, the investors identified a channel with the lower level represented by support and the upper level represented by resistance. As far as the stock price fluctuations do not break out of the identified channel, the investor may sell many times at resistance and buying many times at support.

Rebate trading and Price action

This forex intraday trading strategy is based on the rebates of electronic communication network (ECNs) as the main source of earnings. ECNs may provide rebates to those market actors (either buyers or sellers) who bring additional liquidity through the placement of their lim it orders maintaining the stock prices.

Price action strategies are free forex intraday strategies which are based on the investor's analysis of raw market data such as prices, volumes of stocks, etc., in their numeric form, and the subsequent adoption of decisions based on the combination of the entirety of such technical indicators and forecasting of their possible subsequent movement.

Within the price action forex intraday strategy trading, there may be different tools and their applications. For instance, investors may analyze price volatility, candlesticks or bands, as well as behavioral and other factors. This makes the price action a forex day trading strategy which requires a high level of knowledge and analytical skills from the investor.

An example of the implementation of the price action strategy may be when the investor oversees a scenario under which the stock price should fall by the afternoon. If the scenario is proven to be true (i.e. prices do drop by the afternoon), the investor re-investigates his previous assumptions. If he believes (base on technical analysis data) that no subsequent decrease in prices should be expected, the investor buys such stocks. To the contrary, if prices are expected to further drop, the investor may take additional time before purchasing the securities.

Forex intraday strategies and Artificial intelligence

This intraday forex strategy is based on the use of automatic computation software using complex algorithms for evaluating the current market dynamics and the potential subsequent development scenarios. With the growing scope of technological progress, new automated machines and software have emerged which are capable of learning and generating new algorithms and their deviations based on the new information acquired from the market.

For instance, let's say, securities in a particular market are traded at a particular price, with slight fluctuations over the day. Software registers it and provides algorithmic information to the investors. Then, a close stock exchange market is gaining rapid development, and the investor's stock market is now more prone to greater fluctuations over the daytime in line with the fluctuations on the neighbor market. By using the artificial intelligence intraday forex strategy, the investor may spare significant time and funds, as the software may generate new algorithms which already take into account factors such as the impact of price fluctuations in other relevant markets.

This example is rather simplified, but when there are a majority of differently vectored factors, the use of artificial intelligence may be indispensable, and this forex intraday trading strategy may be the best option to enhance the investor's profits or hedge the inherent risks.