Contents

- What is scalping in Forex and why it is not that simple

- Requirements for a broker

- Scalping strategies and indicators

- Automated scalping trading

- Pluses and minuses of scalping

Traditionally, scalping attracts beginners with the possibility of quick profits and simplicity of outward trading process. In reality, fast and accurate accompaniment of a large number of short-term transactions requires good control and professionalism. It is said that scalping is a style of thinking and natural inclination to such trading style is especially important.

What is scalping and why it is not that simple

Scalping Forex is a trading strategy targeted at opening of a large number of short-term intraday transactions with a small (3-5 points) profit. It is considered as the most aggressive and high-risk way of trading on financial markets. Scalping is the most common on Forex market, on futures and derivatives market.

Regarding the duration of a transaction, there is no well-defined opinion. Initially, it was assumed that transactions will last no more than 3-5 minutes; however, more lengthy periods (up to 15 minutes) are considered as scalping transactions. Only a small amount of profit, which must close quickly under order Take Profit remains unchanged. Before going to detailed description, it is necessary to specify what scalping pips means. Scalping pips is a type of scalping with time intervals of 1-2 minutes, and analysis is carried out by way of tick chart. Technically, it is possible to quickly open and close a transaction with the duration less than one minute in case of direct connection with the liquidity provider (ECN) or with an exchange platform. High-frequency trading (HFT) can be seen as a modern example of scalping pips.

Scalp trader is the most technical player on the market, he must study all the details and "hidden reefs" thoroughly since he is going to earn on micro movements of the price. Particularly, this method of trading has the largest volume of financial losses. It is necessary to remember that, besides the trader, scalping imposes specific requirements for the broker's technical conditions, communications systems, characteristics of the financial asset, and especially tough requirements for trading discipline and money management.

Requirements for a broker

Scalping Forex trading sets high requirements for a broker and for the quality of communication channels:

- In his technical conditions, the broker must expressly allow opening of short-term transactions. Such trading puts additional pressure on the equipment and, in some cases, can lead to technical failures on the broker's server.

- Even if scalping is allowed, attention should be paid to the amount of spread in the selected trading instrument. The average profit under the transaction is small and a large spread can reduce it significantly. Besides that, in case of short-term transactions or publication of important fundamental news, a spread can increase by several times. The main group of brokers promises to keep the spread unchanged; however, sometimes there have been precedents of "unpredictably floating" spread. As a variant of loss reduction, we can consider the transfer to a fixed fee for each transaction.

- The speed of processing of trading orders and the possibility of engaging automatic advisors for scalping. Internet speed can be increased; however, if a broker processes requests slowly, you will never have profitable scalping when every second is important. Automated trading may also be disabled for short-term transactions, and you should make sure it is available before opening an account.

Scalping Forex strategy facts and indicators

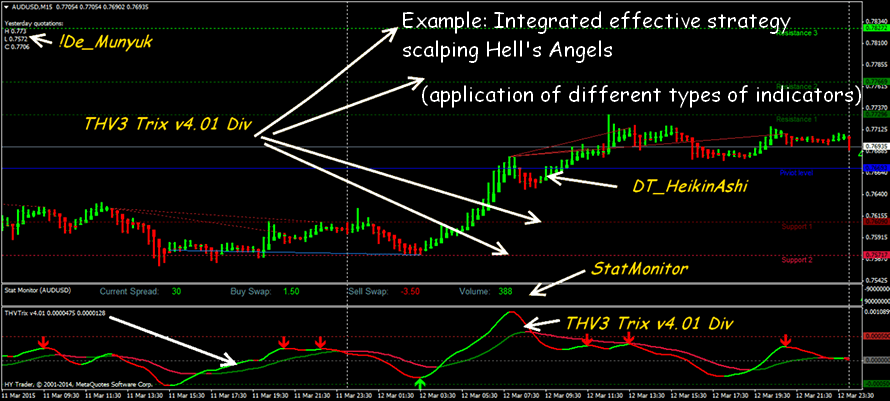

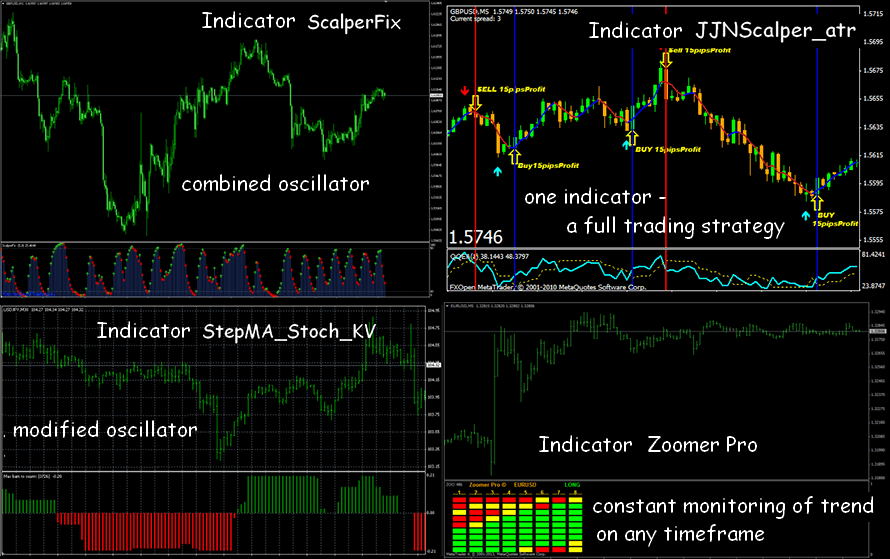

The periods of high market volatility and liquidity are best for Forex scalping. Scalping strategy is based on technical instruments since short transaction periods do not require deep fundamental or graphic analysis. Traditional indicators such as moving averages, RSI and Stohastic overbought/oversold oscillators, MACD trend indicators, etc. are used.

There are no special indicators designed particularly for scalping. Only combined variants based on standard methods are used. Indicators are used only in package, and scalping practice showed that in order to have successful trading, at least one trend indicator and an oscillator that confirms its signals are required. The indicators that combine several separate technical instruments have become the most popular, and there is no need to place them separately on the terminal screen:

Any scalping trading strategy must generate anticipating signals and clearly specify potential profit/loss levels. It is important to remember that entry points are calculated particularly for their quick processing and cannot be used on older timeframes.

Remember: indicators and scalping strategies cease to be effective in case of reduction or, just the opposite, in case of too high market volatility, as well as at the moments of speculative movements, for instance, during news releases.

Recommendations regarding the use of indicators and scalping Forex strategy tips:

- Testing and further trade must be carried out based on similar time frames and trading instruments. In case of their change, all tests must be run again;

- Placing Take Profit and Stop Loss orders is mandatory;

- The strategy must clearly determine the periods of lateral movement of the market;

- You can trust only the results of testing on a real, for instance, cent account;

- "Forecast" indicators do not work on small timeframes.

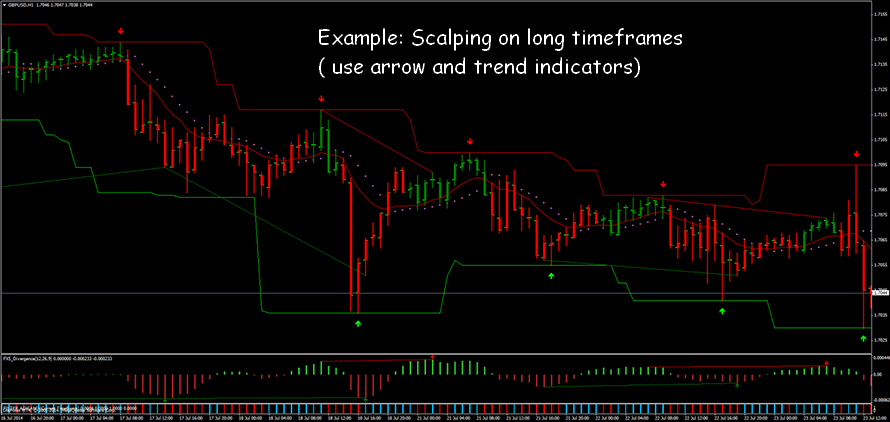

A few words about no-indicator strategies and their use in scalping. Usually, no-indicator strategy is Price Action strategy, when decisions are made only through analyzing graphic patterns on price chart. Initially, this technique was designed for older timeframes - from four-hour old and higher, and it is absolutely useless on small timeframes. The older the timeframes are, the stronger graphic analysis signals will be, and doji candles and other figures produce a large number of false signals on small timeframes engulfs. There are good examples of scalping on Price Action, but it requires great experience and beginners should better use technical indicators.

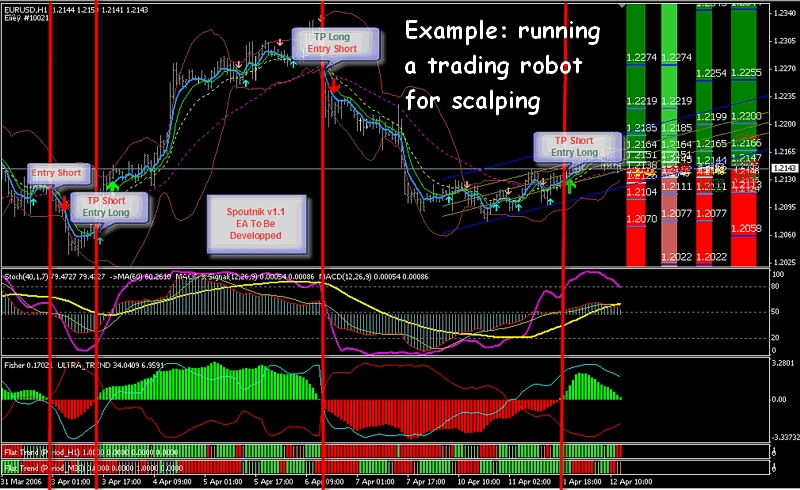

Automated scalping trading

A great number of advisors that implement scalping trading strategies have been developed, and that is quite understandable - transactions last several minutes, they require accurate determination of entry/exit points, and the trader always tends to entrust this process to the program, which never gets tired or has any doubts. We will not focus on any specific advisors and will list only their main capabilities, which they must support for successful trading:

- Almost all scalping advisors use martingale to different extents. However, it will be better if it is completely switched off or trading is carried out with a fixed lot. Remember that any scalping strategies or advisors that use martingale very often result in complete loss of the deposit.

- Set-time function will be very useful when automated trading stops. It is important at the moments of the release of fundamental news, when strong price fluctuations are observed on the market. In case of manual trading, you can make a good profit in such case, but it is better to turn off the advisor.

- When analyzing the market, possible slippage must be taken into consideration. Scalpers will always encounter slippage no matter how much brokers would try to minimize it. Transactions on demo accounts can be opened instantly, and the statistics of all scalping advisors looks good; however, when transitioning to real accounts slippage can significantly spoil the results.

- History-based test results must show gradual growth of profit without dramatic spikes or gaps. A period not older than one and half-two years needs to be used for testing, older periods are not suitable: market conditions change very quickly with regard to scalping, and that produced profit 3-4 years ago does not work today.

It is best to use a dedicated server (VPS) for uninterrupted operation of advisor. Otherwise, in case of the loss of communication with the broker, all open transactions can close, and the advisor will resume its operation "with a clean slate", which, in case of scalping, can result in big losses (especially in cases when martingale is used).

Pluses and minuses of scalping

Short-term transactions allow fortunate players to earn on each market movement. It is only important to remember and understand all pluses and minuses of Forex scalping.

Advantages of scalping:

- Possibility to gain quick profits;

- Minimum requirements for deposit amount: due to a large number of transactions, it is possible to gain good profits even on cent accounts;

- Scalping strategies have weak dependence on the global market trends and fundamental factors. It is enough to monitor only the moments of the release of important news and statistics, in the other periods - only technical analysis will be sufficient;

- Automated trading with the use of advisors.

Shortcomings of scalping:

- If automated advisors are not used, manual opening/closing of a large number of short-term transactions impose high requirements for professionalism and psychological stability of the trader;

- The need for continuous control over the transaction different from mid and long-term transactions when it is enough to visit the terminal 1-2 times a day;

- High risks of losses while producing small amounts of profit;

- High requirements for technical conditions: low spreads, absence of slippage, high speed of processing of requests;

- Continuous control and setup of strategy or advisor parameters. Any change of the market condition may cause a failure in trading, and profitable short-term strategy may start causing quick losses, especially in case of automated trading.

In order to catch a moment when the market produces a price jump, on which the trader can complete a transaction successfully and earn, it is necessary to develop professional intuition. Today, scalping techniques (or their partial use) are available for everybody; moreover, no relevant fundamental analysis or very complicated indicators are required for that. However, any Forex strategy in scalping requires solid technical training, and, mandatorily, personal successful experience.