特朗普发烧渐减。真的可以治愈吗?

Trump's and Yellen's performances in traditional tones are compensated each other, removing the stress of the markets before a FRS meeting. Euro is nervous because of the French battles, Arabs offer a discount for the oil, third world countries hurry to place euro bonds before the increase in the American interest rates.

In the first normal presidential speech – before the Congress – Trump change the tactics and, trying to sell the populism in more attractive packaging, called the nation for overcoming disagreements. Bellicosity of rhetoric remains, but it began to sound more softly to mitigate the loss of reputation in the public opinion. The solo policy of president Trump is rather limited – implementation of practically all election promises requires a consent of legislators and the active coalition with opponents.

Details of tax policy, reform of internal programs for the increasing in military expenses weren't sounded, but the policy in the field of deportation is slightly democratized. In fact, so expected speech was the presentation without figures, terms and details, but the markets were patient and optimistical, and they will remain such within even some time. The request to the Congress for $1 trillion («infrastructure investments»), solidarity with NATO, an exception of Iraq of the law on immigration is confirmed. An expected nearest increase in a FRS rate, and also the factor that next year the management of FRS, most likely, will be replaced is Trump's advantage. If the president really wishes depreciation of the dollar, then replacement of Yellen and appointment someone else «softer», than it, is required. If we see soft budget policy, as well as the markets expect, it will be a positive signal for the growth of the economy and the stock market.

Yellen considers that change of rates, «possibly, will be pertinent to» on March 15 if data on employment and inflation keep meeting expectations of the regulator. It's difficult to estimate these factors because the data on a consumer price index releases in the day of a FRS meeting, and its favourite indicator of inflation − only on March 31. The formulation, as always, gives an opportunity for the imagination, but knowing Yellen, it is possible to consider that direct order on increase is made. FRS comes close to the purposes: (stable inflation near 2% and the level of unemployment in 4,8%) that almost corresponds to an indicator which considers steady in the long term. If the next report on NFP is strong, then the growth of rates in March will become a solved case.

The House of Lords of Great Britain voted for amending the bill of Brexit for the purpose of guarantees for the inhabitants of the EU who are already living in Great Britain to keep this right, but May surely uses the majority in the House of Commons for overcoming this decision. The British lawyers came to a conclusion that Great Britain legally has all reasons not to pay to the European Union nearly €60 billion under earlier signed agreements after Brexit, and Brussels has no legal causes to require this money. The country can suggest paying voluntary projects of the European Union till 2020 and pension of officials, only if it provides to Britain exclusive access to the markets and a cooperation in such areas as justice and safety.

Euro grew on the French rumors of replacement of Fillon by Juppe, and in general, any information on candidates will become the powerful driver for EUR/USD growth. The decision on replacement of the candidate shall be made until March 17 − this day registration of presidential candidates of France stops. Euro can grow before a meeting of the European Central Bank on March 9 against the background of rebalancing of portfolios of investors in expectations of reducing the size of the QE program. Anyway, this meeting is transit and future policy of the European Central Bank is directly connected with election results in Holland and France.

From other news we will note:

- On Wednesday the head of European Commission Junker provided «The white book» in which a future assessment after Brexit and the main problems of Europe in the next decade is given. In the document 5 scenarios of development of the EU during the period till 2025 are offered. Time of the publication is dated for the celebration of anniversary – 60 years from the moment of signing of the Roman agreement will be performed on March 25. Meanwhile, they keep to buy up the euro, and it is clear to what means - money comes from the settlement of a short debt.

- To stop loss of a share in the market, Saudi Arabia sharply reduced the prices of all grades of the oil for ALL clients that became a surprise for the market. The maximum discounts were received by partners in Asia - the key market for Arabs, the European clients – a discount in $0.10-0.45-0.60, in the market of the USA a discount will constitute $0.10 for heavy brands of oil and $0.20-0.30 for lights. In 2016 Saudis for the first time lost the status of the largest oil supplier to China (having yielded to Russia), and total exports fell to 7,04 million. bar/day – a minimum since 2015. Besides, the new competitor returns to the market − against the background of the growing production and the crowded storages (520 million barrels) slate America closes that niche in the market which was left by OPEC after the war for production reduction. And the American oil started again arriving in Asia, and total exports grew to 1,2 million bar/day for the end of February.

- The bitcoin rate for the first time in the history rose higher than gold prices: at the moment of closing the biddings in the electronic exchange Kraken on Thursday, the bitcoin cost $1268, whereas gold — at the level of $1233 for a troy ounce. After the performance Dow Jones updated a historical maximum, for the first time having exceeded a mark in 21000 points, the global stock exchange indexes, including S&P 500 reached for it. Considering that any of initiatives of Tramponomika didn't get the approval of the Congress yet (neither decrease in taxes, nor increase in budgeted expenses), the current market reaction can't be caused only by actions of the new president. Investors see low interest rates, GDP growth and snailishness of actions of the Central Banks in relation to soft monetary policy. It is the recipe of the bull direction in the markets even if the course of president Trump will be a deadlock.

For a dollar this week was the best in 2017 - but then there were strange movements, especially after the Yellen's performance. On Friday the US dollar considerably fell in price, having updated a minimum on March 1 that was caused by the partial fixing of profit and correction of positions in the run-up to the speeches of FRS representatives.

In addition to NFP, next week all who work on Asian assets should pay attention to data of Australia and China (a trading balance in the Wednesday morning, data on inflation on Thursday). In general, China requires a special attention after implementation of reorganization of trade relations with Asia by Trump, the possible growing animosity can begin after the summit of the Ministries of Finance and heads of G20 on March17-18. The trading balance is interesting concerning Britain, but the statistics can be useless as, according to information leakage, the government initializes article 50 next day after ratification of the Brexit bill by parliament that will allow beginning negotiations with the EU on April 6.

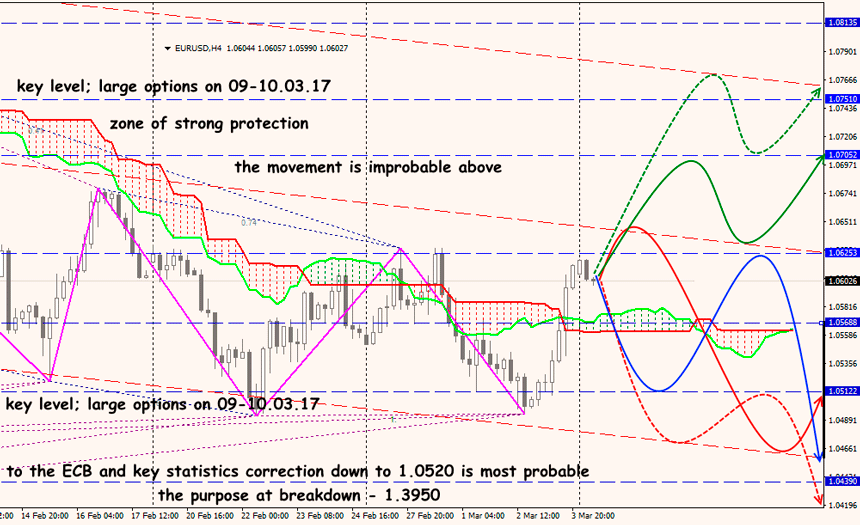

Technical Analysis EUR/USD

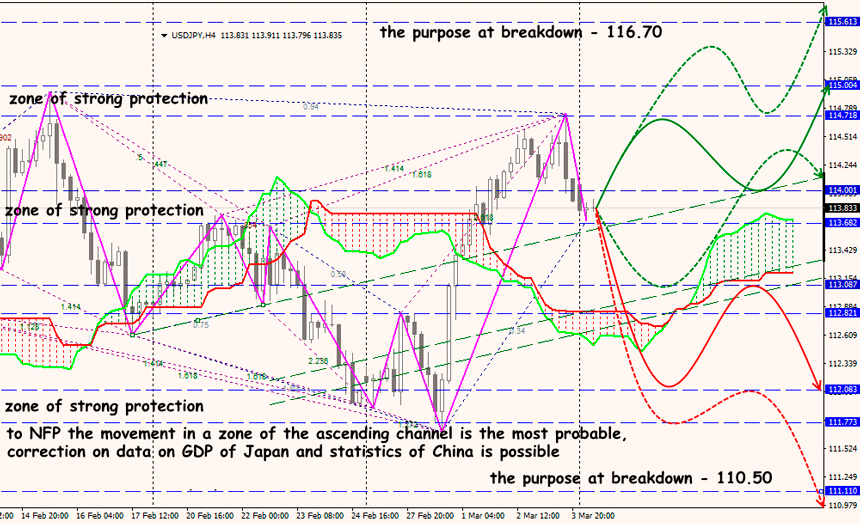

Technical Analysis USD/JPY