Contents

- General features

- Demark Swing trading strategy

- Middle Bollinger Band

- Floor Traders

- Advantages and Shortcomings

- Conclusion

While intraday forex strategies allow traders generating greater profits within narrower timeframes, forex swing trading strategies may be effective when timeframes are wider and extend from 2 days to as much as 2 weeks. This publication will illustrate the best swing trading strategies to suit best your trading.

General features of Swing trading strategies

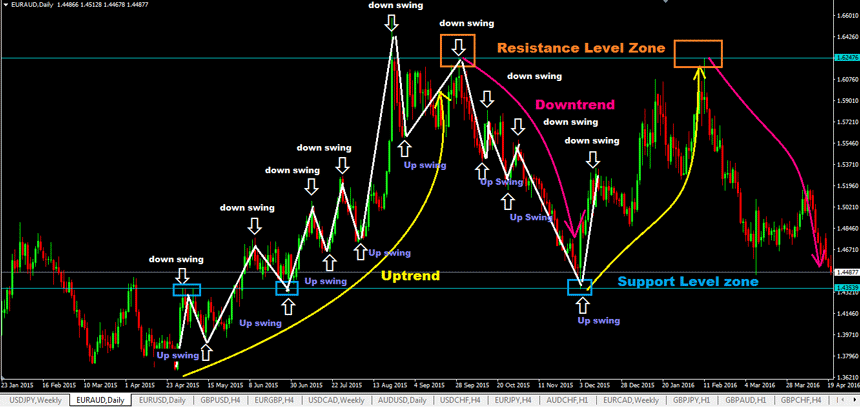

Swing trading as a type of stock market trading is aimed to achieve yields from transactions with a hold ranging from overnight to a few weeks. Capitalization within swing trading occurs based on short-time prices fluctuations of the forex market. Traders applying swing trading forex strategies are required to track the short-term market tendencies and trends, and to move their capital quickly within their transactions. The monitoring of support and resistance becomes crucial in this context, and the trader may use technical or fundamental analysis for assessing market trends.

The trader's goal within a swing trading strategy in the forex market is to identify the existing trends by means of computations, and to enter trade near the beginning of the respective, but not near its end. Thus, swing trading is also aligned with market trends, and may be effectively applied in the short-term perspective, but beyond one-day length.

Demark Swing trading strategy

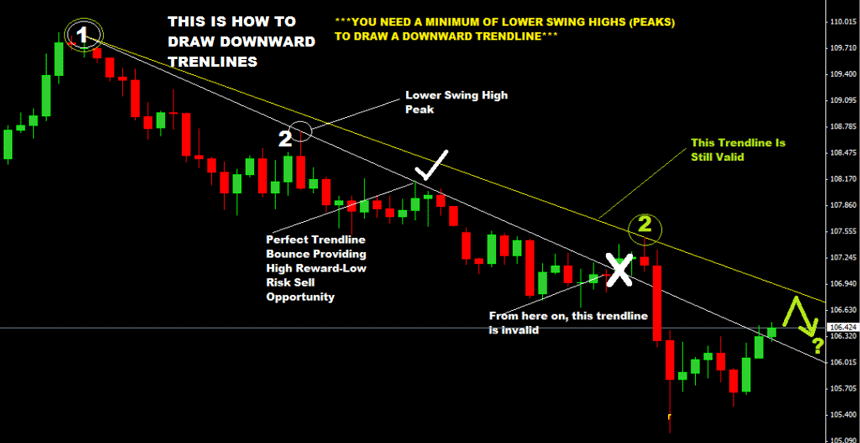

The Demark swing trading strategy is a trendline simple swing trading strategy based on the creation of trendlines from recent highs and lows and opening of positions with trendline breakages.

Trendlines may be either upward or downward. An upward trendline is drawn by connecting two price lows and continuing the line obtained. To the contrary, for a downward trendline it is required to find two price highs and connect them.

So, the first step within the Demark swing trading forex strategy is to draw the trendline based on the nearest bottoms and peaks of price values. Next, the trader should wait until the trendline is broken for revealing the signaled trend direction. Next, at the broken candlestick's closure, the trader places a pending order to either buy or sell, positioning it just several pips away from the candlestick's bottom or peak. In this case, take profit will be located at the previous swing highs or lows. Stop loss can be put behind the respective highs or lows.

The Demark swing trading strategy may be the best swing trading strategy, if the trader is able to effectively use basic technical analysis tools, and therefore it can be used effectively even by novice forex market traders.

Middle Bollinger Band Swing Forex trading strategy

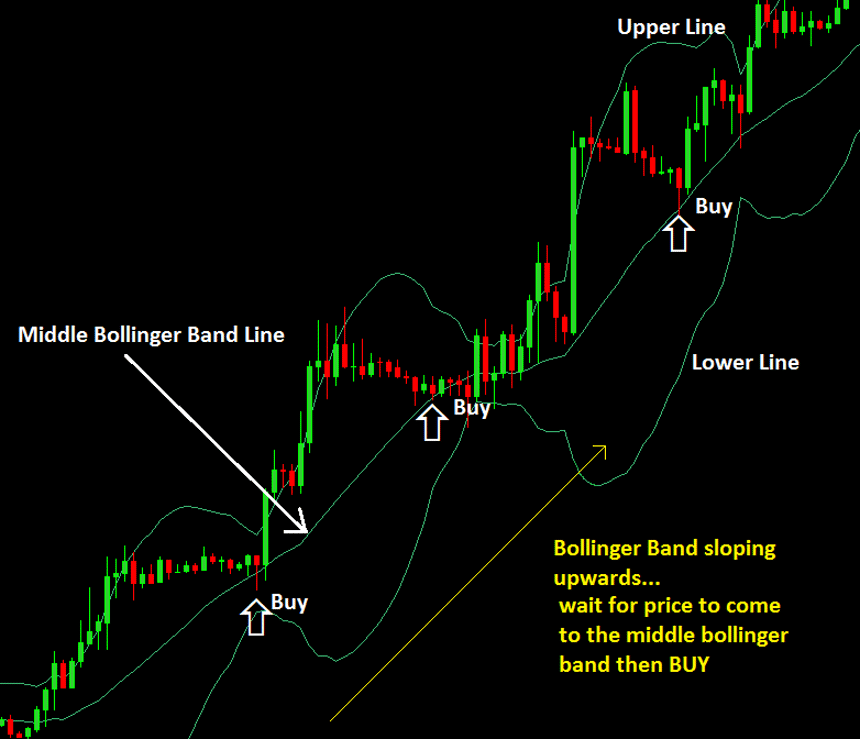

As suggested by its name, this forex swing trading strategy relies on the application of the middle Bollinger line as the main indicator. This indicator signals the need to entry trade when it is touched by a candlestick.

The Bollinger bands are lines located above and below SMA. When market volatility rises, the bands widen, and to the contrary, when market volatility drops, the bands narrow down. The middle line (SMA) is most often set at 20 periods. The two outer Bollinger bands are located two standard deviations in top of and below the SMA line, respectively.

When using this forex swing trading strategy, the trader is generally guided by the following indications: when the middle Bollinger line is pointing or moving in the upward direction, the situation is favorable for buying, and to the contrary, when the middle Bollinger line is pointing or moving downwards, the situation is favorable for selling. Only the middle line is used as the indicator, and not either of the outer lines.

Buy order: if a candlestick reaches the middle Bollinger line, the best option for placing stop loss is the lower outer Bollinger line. If the candlestick closes, stop loss can be moved up to at least 5 to 15 pips below the bottom the entry candlestick. When the candlestick that reached the middle Bollinger line first is closed, stop loss should be located at least 5 to 15 pips below the bottom the entry candlestick.

For a sell order, stop loss should be put at the level of the upper Bollinger band or 5 to 15 pips above the peak value of the entry candlestick. In buy trade, take profit is at the moment when a candlestick reaches the top Bollinger line, and to the contrary, in sell trade, it is when a candlestick reaches the bottom Bollinger line.

Although the middle Bollinger band strategy might seem complex, it is an easy forex swing trading strategy which requires the application of basic trading skills and knowledge.

Floor Traders Swing trading strategy

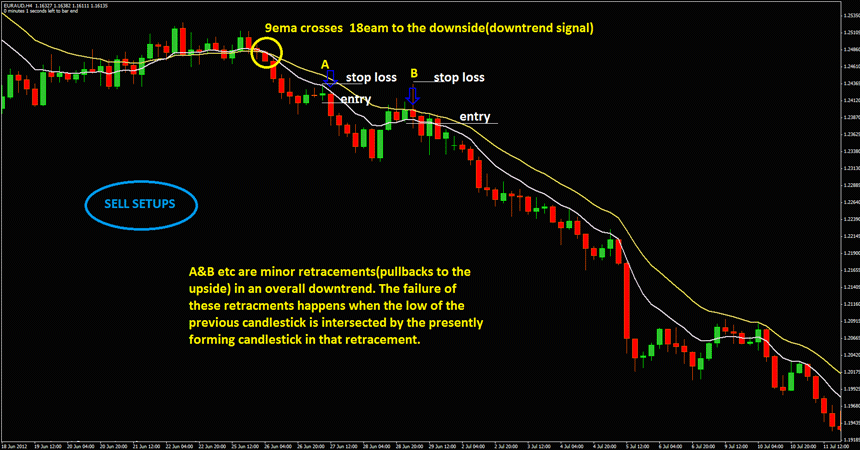

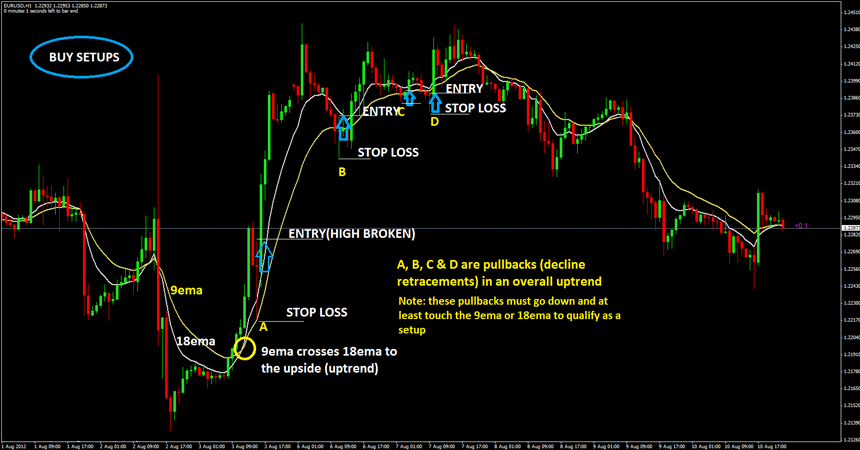

This swing trading strategy is first of all set to reveal the persistence of a trend. Moving averages are applied for identifying trend movements within this strategy. Trading signals are formed after retracement. Retracement can be defined as a minor price rally in the upward direction (in case of downtrend) or downward direction (in case of uptrend). Retracements are temporary effects which need to be effectively monitored.

For selling under this strategy, 9 EMA has to cross 18 EMA to the downside, thus forming a downtrend signal. Then, the trader has to wait for retracement. When a candlestick touches 9 EMA or 18 EMA and if the previous candlestick's bottom is broken, this is the signal to sell. Stop loss should be place 1 to 5 pips above retracement high.

For buying, 9 EMA needs to cross 18 EMA to the upside, thus forming an uptrend signal. When retracement occurs, the trader needs to monitor candlestick highs. If a previous candlestick's high touches 9 EMA or 18 EMA and is broke, this is the buy signal. Stop loss should be placed 1 to 5 pips below retracement "through".

In both cases, take profit should be trice as big as the risks incurred.

Advantages and Shortcomings of swing trading Forex strategies

The main advantage of swing trading strategies in the forex market is the fact that such strategies allow conveniently managing take profits and stop losses. Early stops can be avoided by placing stop losses away from the level of market price. Also, due to the larger timeframe, swing trading strategies can be used with smaller risks as compared to intraday forex strategies. Swing trading also takes less time. Finally, when implemented effectively, forex swing trading strategies may bring substantial profits to traders.

The main disadvantages of swing trading include the need to run a thorough analysis of the trading setups, which might take substantial time, it may require thorough monitoring, and it may take longer time to generate yields in the long run.

Conclusion

Finding the best forex swing trading strategy for your transactions might be a complex task on the initial stage, but as soon as you are done with it, you will be able to broaden your trading potential and to generate greater trade results. Use swing trading together with your other trading strategies, and maximize the effectiveness of your trade!