Contents

- Main principles of Price Action technique

- Basic notions of Jarroo method

- How to trade using Jarroo method?

- Individual notes - DCC

- Stops, profits, etc.

Today, no-indicator trading systems are at the height of their popularity. They are successfully used by both beginners who do not have enough technical skills and practical understanding of the market yet, and by experienced traders who have grown tired of searching a real price under the layers of sets constructed by indicators. Jarroo strategy is a great offer for those who look for safe trading and do not want to waste a lot of time on technical analysis.

Main principles of Price Action technique

Price Action technique is a particular case of the classical analysis of Japanese candlesticks, which is supplemented with the interpretation of price levels:

- A trading decision is made only by the results of price bar analysis;

- No technical indicators are used, and due to that, traditional delay of entry signals and possible redrawing are eliminated;

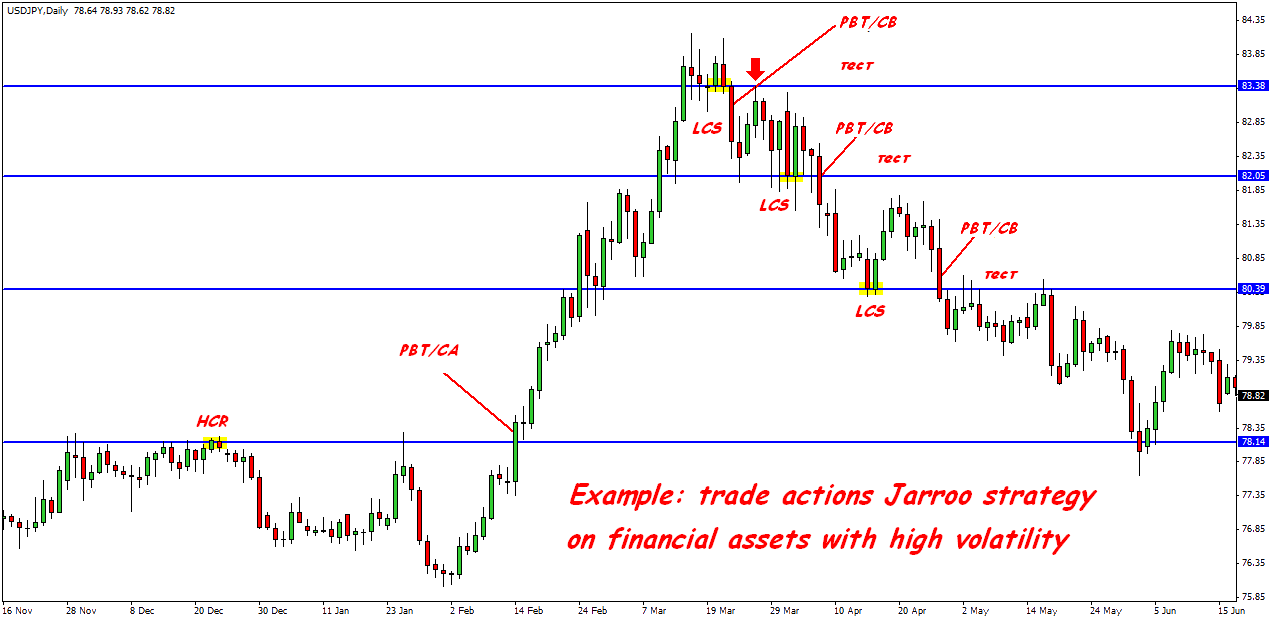

- It is possible to use moving averages for trend confirmation with regard to volatile assets;

- The analysis is carried out on daily time frame, which increases the accuracy of technical analysis;

- Patterns selected as typical produce virtually no false signals;

- Transaction enter and exit are carried out only upon the completion of a pattern.

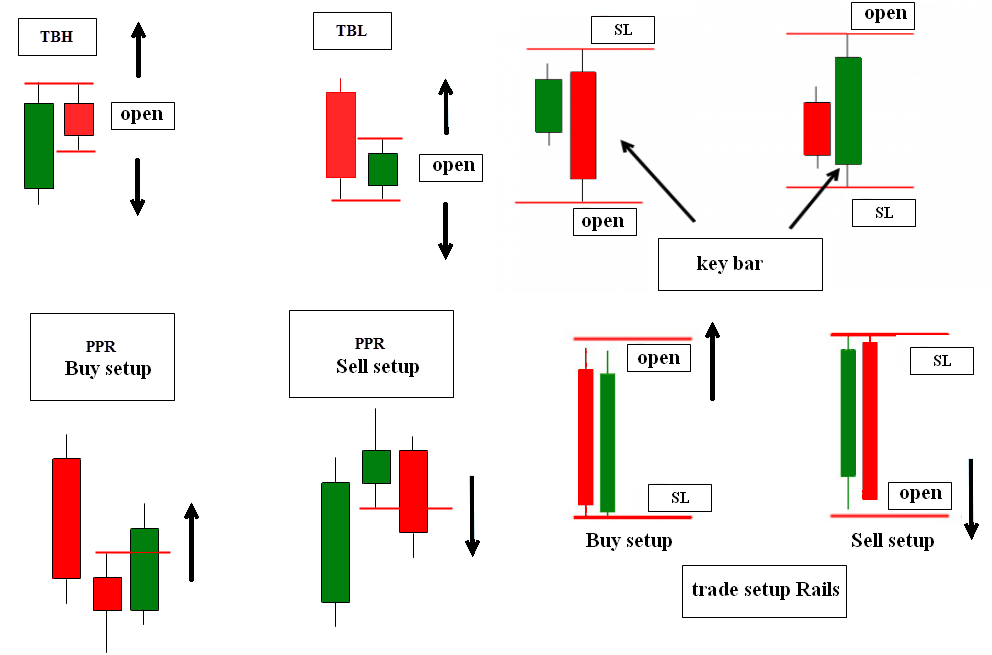

The most popular Price Action patterns, including those used in Jarroo method, are presented below.

Basic notions of Jarroo method

All the below notions are part of the Price Action theory; however, in this technique, they are used with some additions and original interpretation.

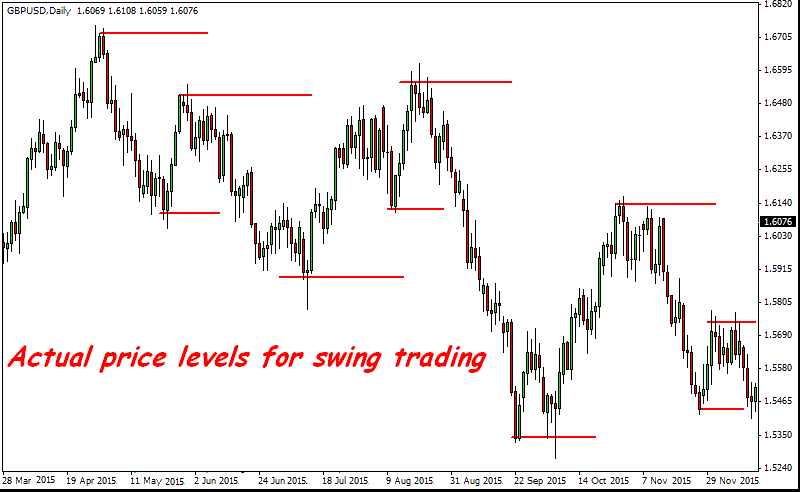

Swings. Forex swings are local min/max in case of price movement, which look like points (zones) of reversal of the main tendency on the chart.

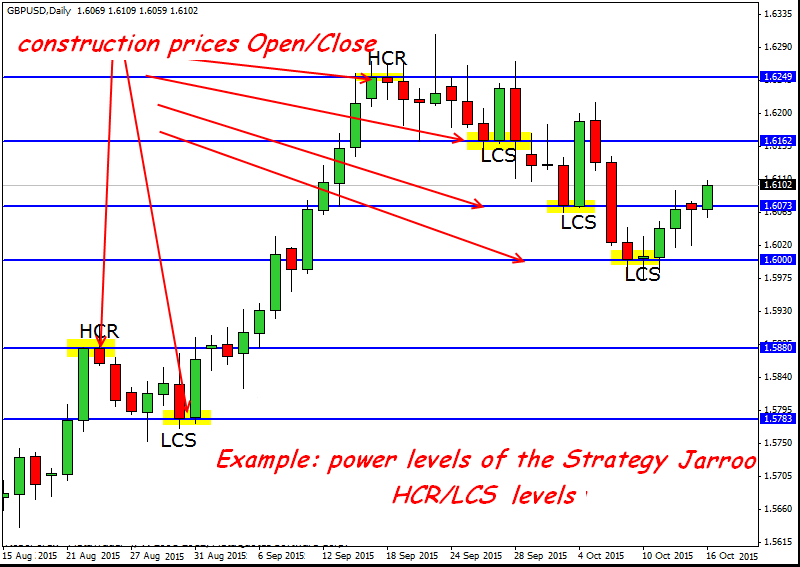

HCR/LCS price levels. The specifics of this method is construction of price levels using not the candlestick shadows but rather open/close prices. Levels in which zones the price could not close:

- LCS (lowest close of support) is below;

- HCR (highest close of resistance) is above.

There are many situations like that that occur on the chart, but only the most significant ones are taken into consideration. Condition: not less than two candlesticks with the similar open/close price must appear.

PBT/CA and PBT/CB levels. Basic terms for proper understanding of the situation and the beginning of trade. They characterize the moment when the price opens and closes:

- PBT&CA (or price breaks through & closes above) is above;

- PBT&CB (or price breaks through & closes below) is below.

Based on the fact that LCS and HCR levels are previously marked, it is necessary to wait for the price to move close to them and see how it behaves in the zones near the levels. If the price penetrates them and consolidates above HCR (resistance), that means it is PBT&CA, if it is in LCS (support) area - then it is PBT&CB.

How to trade using Jarroo method?

Everything is very simple:

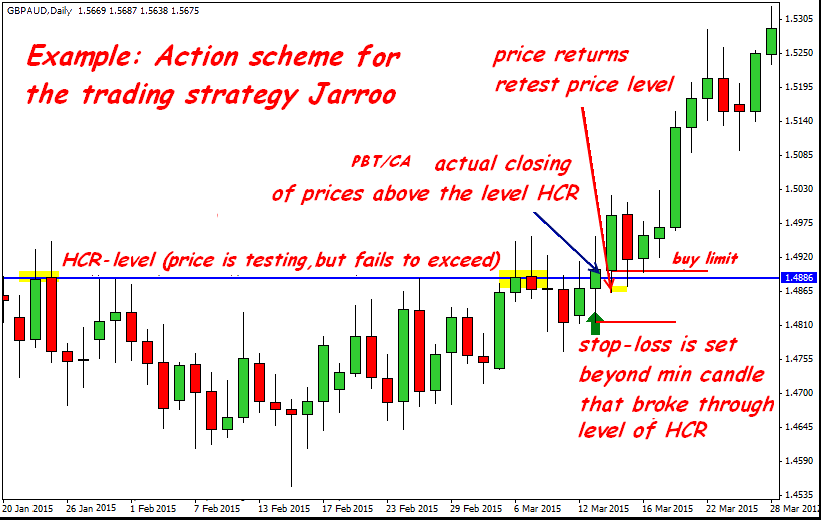

In case of PBT&CA, the pending purchase order is placed directly at HCR level (taking the spread into consideration). The stop order should be placed behind the min of the candlestick, which penetrated LCS level.

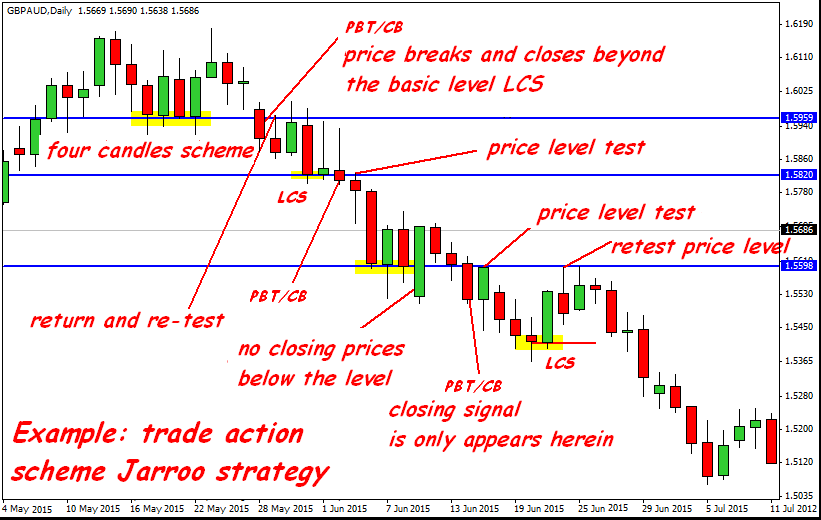

In case of PBT&CB, the pending sale order is placed at LCS level (taking the spread into consideration). The stop order should be placed behind the max of the candlestick, which penetrated HCR level.

The main trading idea is particularly based on the fact that the price after penetration of such a level returns, tests the level again, and only then starts moving in the main direction.

It is something like this:

Or this way:

An example of trading with regard to a more volatile asset:

The accuracy of the entry depends on the "importance" of the candlestick, on which the entry was made. You shouldn't immediately respond to any candlestick with similar opening/closing price: in order to enter, it is necessary to have clearly formed swings or a penetration of a strong price zone to occur. Besides, it is necessary to pay attention to the presence of "round" price levels, around which the price, as a rule, violates all the technical analysis rules. Strong graphic reversal figures formed according to the standard candlestick analysis can also impede trading with the use of Jarroo method.

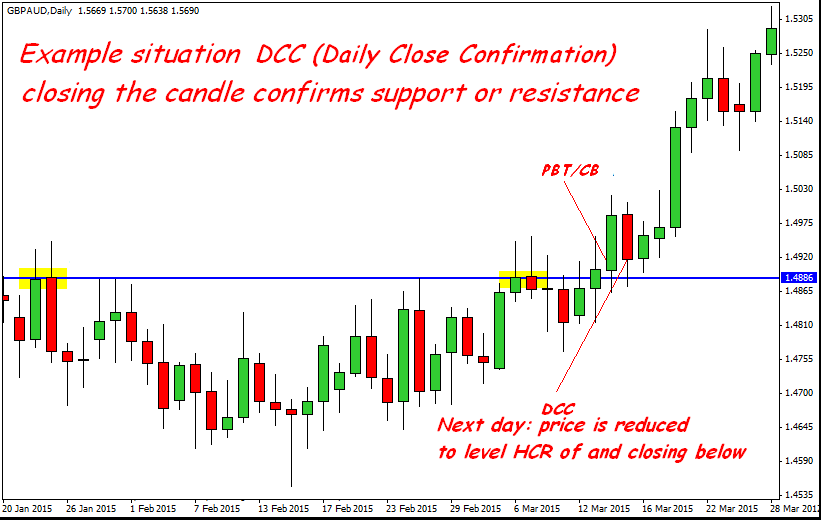

Individual notes - DCC

An abnormal situation in Jarroo system - DCC (Daily Close Confirmation): it is necessary to confirm support/resistance level by closing of a daily candlestick. Let's assume that HCR level has been penetrated, RBT/CA is forming, and we need to place the pending purchase order at this level. However, if we prefer more conservative trade, we should wait for closing not below this level of the daily candlestick, i.e. this level must be confirmed additionally. The picture looks similar for LCS level and RBT/CB.

Stops, profits, etc.

In case of operation using this trading system, nearby stops are contraindicative. Trading is carried out on D1, therefore, targets with regard to stops are either the nearby zones of support/resistance levels, or shadows of previous candlesticks. In this regard, nervous beginners are not recommended to transfer stops to breakeven when reaching the first target level and then to close the position in parts. You can pull up stops using trailing, according to price levels.

Those who find Jarroo trading strategy in Forex too complex due to a large number of patterns and conditions, simply did not try to trade using advertised trading systems with several dozens of indicators, whose signals contradict one another in the process. Having gone through some eye training, the trader will see standard patterns on the price chart free of redundant constructions, and the main benefit of the method offered is that key support/resistance levels and Take Profit and Stop Loss price are determined very accurately. Moreover, Jarroo method in Forex can be easily combined with regular indicator techniques. It is a mid-term system, you can see its effects at least by the results of several days' work.