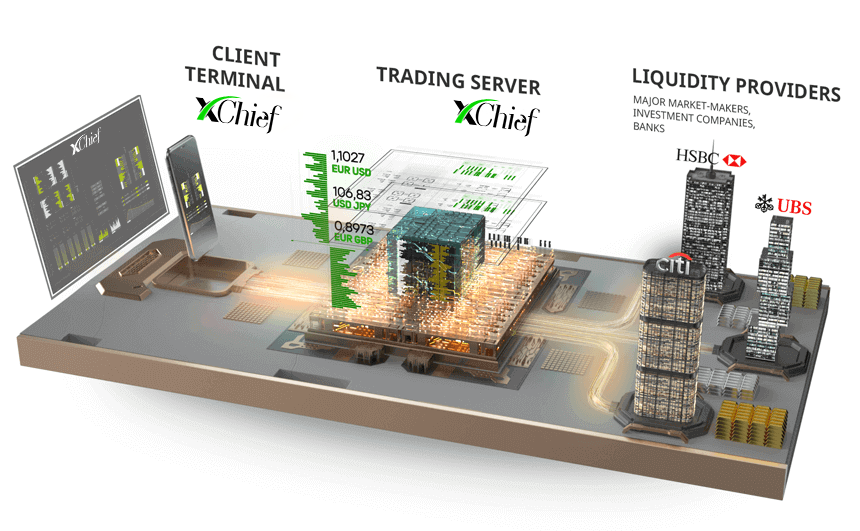

Liquidity Aggregator

Our in-house high-end liquidity aggregator was developed to address the limitations of existing market technologies. It aims to mitigate risks associated with the STP/NDD agency model by avoiding reliance on a single liquidity provider. Additionally, the liquidity aggregator enables us to secure the best possible prices for our clients, as we are not dependent on the customized feeds of the largest market makers.

The modular system not only consolidates liquidity from ECN-platforms, banks, large market makers, and institutional brokers into a unified stream but also enhances the quality of execution for trading orders. Technological contributions from numerous providers in liquidity aggregation have positioned xChief as a competitive force, offering traders high-speed order execution, narrow spreads, minimal slippage, and a low rate of rejected orders.

With a transparent order execution policy accommodating both positive and negative slippage, the aggregator model is an integral component of the company's business logic, enabling it to compete effectively in the foreign exchange market.

The benefits for our clients cannot be overstated. The aggregator, combined with the MetaTrader 4 platform and our bonus programs, not only enhances trading conditions but also ensures a seamless user experience, significantly improving the chances of long-term success.

Liquidity Aggregation Scheme